There aren’t that many consumer tech businesses operating at a truly continental scale in Africa.

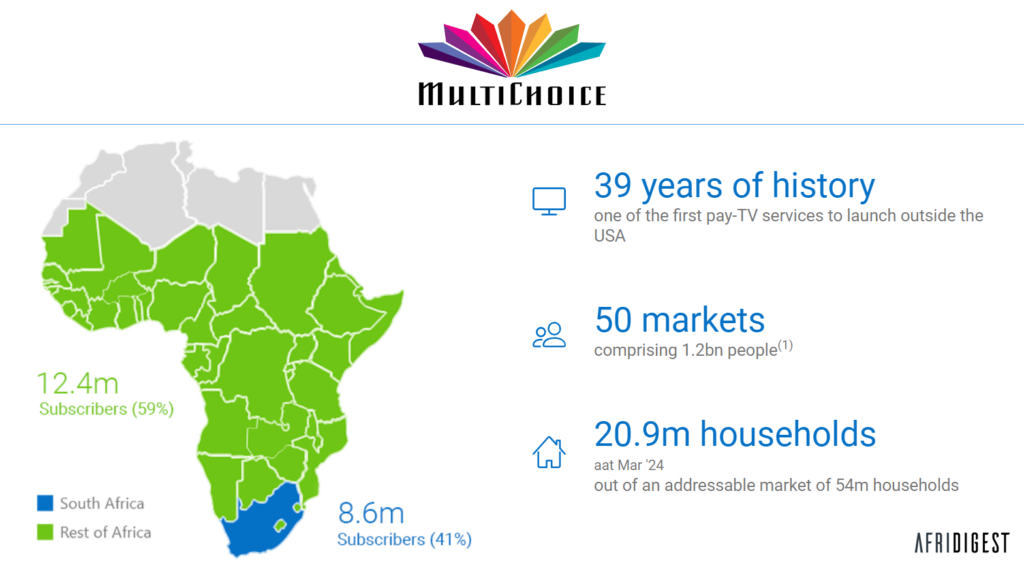

One of them is South Africa’s MultiChoice. The JSE-listed video entertainment platform is Africa’s biggest pay-TV company and has a subscriber base of 21 million households across 50 African countries.

Given the company’s footprint across the continent, MultiChoice’s management team can offer important context & insights about economic and industry trends relevant to doing business across Africa.

Last week, the company released its FY 2024 earnings results (PDF) that include some choice quotes from its leadership team.

General quotes:

- “Volatile and weaker local currencies … and a weak consumer environment due to rising inflation and high interest rates have created an extremely challenging environment.”

- “In the face of a deteriorating macro and consumer environment … many of our would-be customers cannot afford to consistently pay for our product.”

- “Mass-market customers … had to prioritize basic necessities over entertainment.”

Country-specific quotes:

- “The South African economy continues to endure severe economic pressure, with consumers under financial distress due to the cost-of living squeeze from high inflation and interest rates. Consistent loadshedding through FY24 created an environment where customers without backup power were reluctant to subscribe to our service due to the uncertainty of whether they would be able to watch.”

- “The Nigerian economy and consumers faced persistent challenges through FY24. The removal of fuel subsidies, sharp currency depreciation with the official naira halving in value, inflation climbing to over 30%, and higher emigration of the middle and upper class drove an 18% YoY decline in active subscribers.”

- “The pressure on the Kenyan shilling, down 17%, necessitated two price increases which brought the total increase for the year to 9%.”

- “Zambia was impacted by high inflation, power shortages, delays in salary payments to government employees and a 20% weakening of the Zambian kwacha.”

- “The Angolan kwanza was under significant pressure, with the average rate 70% weaker.”

Not pretty at all.

There are multiple takeaways here, but I’ll end with a quote from Tope Lawani, co-founder and managing partner of Helios Investment Partners, a firm with one of the strongest track records in African private equity.

It makes plain his thinking about investment opportunities across Africa given the mythmaking about the continent’s middle class and the purported rise of the African consumer. And it should provide some food for thought for Africa-focused innovators and investors alike:

Source: Helios Investment Partners (PDF)

Share: